|

Global telecommunications carriers create billions

of operational transactions - business events and service records -

every day. Whether it’s fixed or mobile, in-country or across the

world, the telecommunications carriers are, in effect, huge

transaction companies that must sort through every call record,

termination charge, tariff change, and switch record in order to

smoothly and efficiently interconnect the world’s communications. When

interconnect represents 40 to 60 percent of gross margin for a typical

carrier, the failure to quickly and correctly process, analyze, and

respond to ever-changing rates, routes, and regional requirements can

very often be the key difference between profitability and loss for a

carrier.

A More Complex Business Environment An expanding

array of services such as VoIP and mobile services, along with the

exponential increase in the number of service providers have brought

about a new set of challenges for international service providers

including effective agreement management, optimized routing for IP/TDM

networks, and enhanced revenue assurance. In addition, deregulation

and regional consolidation between carriers across a geographical

region has created the need to manage the interconnect business at

local, regional and global level.

This changing telecom

landscape is transforming the interconnect settlement process which

has long relied on agreements with a limited number of other telecom

carriers based on long-term agreements, predictable volumes and simple

per minute pricing. Now, carriers are entering complex business

agreements with multiple partners, each with a different settlement

and rate plan. As a result, carriers are being forced to devote

substantial resources to track and ensure that the financial

obligations of each agreement are satisfied.

The legacy interconnect

and settlement systems which most service providers have relied upon

in the past are struggling to meet today’s dynamic requirements.

These systems typically suffer from lack of functionality, are

cumbersome to change and enhance and most importantly, expensive to

maintain. As a result, the usage and rate information that is

generated by these systems is often not accurate--resulting in

significant vendor invoice reconciliation issues and lost revenue. To

succeed in today’s dynamic business environment, service providers

must deploy a comprehensive interconnect OSS/BSS which provides

effective agreement management, optimized routing for IP/TDM networks,

and the ability to quickly and efficiently bill and audit payments

from multiple partners.

Complex Agreement Tracking and Management

Today,

a typical carrier is interconnected to between 40 and 200 carriers,

each of which is sending multiple rate and dial-code change

notifications each month. Each offer contains details ranging from two

to as many as 1,000 international breakouts. As a result, a carrier

may have to track between 40,000 and 300,000 offer details per month.

The increase in the

number of fixed, mobile and VoIP carriers, as well as the tremendous

volume of daily traffic that is routed on a carrier’s network has

compounded the complexity of managing this process. Typically tracking

traffic, costs and revenue has been done manually using Microsoft

Excel, disparate software solutions or even faxing price documents

back and forth between carriers. The ability to quickly and correctly

process, analyze, and respond to the ever changing rates, routes, and

regional requirements is becoming the key difference between

profitability and loss for a carrier.

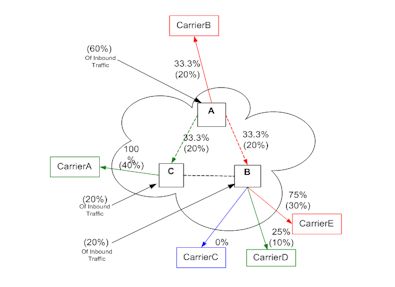

Next Generation Optimized

Routing is essential

To address the dynamic

business demands associated with today’s complex interconnect

agreements, carriers will also need the ability to create and

implement global routing strategies in near real time. Yet for many

carriers, commercial routing and technical routing have long been

operated as separate organizations, each with its own business

objectives. This severely limits a carrier’s ability to build global

optimal route guides at the commercial as well as technical level. In

addition, while some of the new softswitches provide better routing

capabilities and some basic LCR support, they are unable to manage the

financial optimization of the network or define quality, margin and

other benchmarks for each switch, service, and destination. As a

result, a carrier’s ability to react quickly to financial risks and

changing network conditions associated with commercial agreements is

severely limited.

The Financial Risks

Associated with Dial Codes

Another challenge in the

current interconnect structure is due to the fact that carriers

receive international termination rates that are based on their

vendors’ destination and dial code number plans. These number plans

are typically different from the carrier’s own number plan and this

discrepancy results in ambiguity around a carrier’s cost of

termination to their interconnect partners.

Traditionally,

interconnected carriers conducted business by exchanging termination

rates to specific countries or geographic locations such as city or

region. The locations are defined by dial-code details. It is this

detail that can provide each carrier with significant risk and

opportunity. A major industry-wide challenge is that there is no

single standard for international numbering plans. Niche international

markets evolve seemingly overnight. This rapid fluctuation makes ITU

dial-codes inherently outdated and non-reflective of how business is

actually transacted. With the rapid expansion of mobile services such

as paging, GPRS and an increased use of number translation services

that are geared to both public and private use, a continuous pattern

of number plans and change band breakouts is developed.

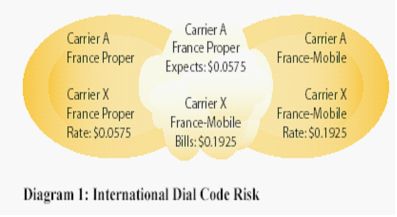

This industry-wide

problem translates into carrier risk because each carrier is defining

their “view” of the world in the form of their dial-codes. A carrier’s

dial-codes drive their cost, routing, pricing, and billing operations.

The carrier risk comes from the differences in how each carrier

defines the dial-codes and the pricing associated with those

differences. As a result, it is common to have a carrier send traffic

to a country assuming it is being terminated and charged as “landline”

traffic when it reality (due to the dial code in use by the other

carrier) the traffic is actually routed and terminated as mobile

traffic, at a significantly higher cost.

For example, assume an

operating carrier (Carrier A) routed 1,000,000 France minutes (50%

proper, 50% mobile) to a vendor (Carrier X) in a month. 50% of the

France Proper minutes (250,000) were treated by Carrier X as

France-Mobile. This results in an unexpected billing of an extra

$0.1350 per minute (the difference between the $0.1925 mobile rate and

the $0.0575 proper rate) for each of these 250,000 minutes. A total

unexpected cost of $33,750.

The Importance of

Interconnect Business Optimization

To address these challenges and capitalize on the reduced costs

associated with IP centric networks, many forward thinking carriers

are deploying Interconnect Business Optimization solutions.

Interconnect business optimization, or IBO, is focused on improving

processes within carrier operations as well as providing the analysis

tools necessary to detect and remedy areas of potential revenue

leakage or cost inefficiency. Interconnect Business Optimization

enables carriers to more optimally leverage their operational

intelligence to manage, route, bill and audit their interconnect

traffic. These innovative solutions are able to define and manage an

infinite number of interconnect agreements with other carriers and

content partners, regardless of the level of complexity. This level

of flexibility enables a carrier to support a variety of agreement

types and rating scenarios including multi-party settlements and

sophisticated revenue sharing partnerships.

By incorporating the

cost and margin associated with each partner agreement, current

network conditions and user defined quality of service benchmarks,

carriers can produce optimal route suggestions at both the commercial

as well as the technical level. Carriers can also automate their

entire global routing process so that optimized network route guides

can activate routing changes directly through both TDM and IP switches,

without any user intervention.

Enhanced Revenue

Assurance

Interconnect

Business Optimization solutions also provide carriers with ability to

detect and eliminate areas of potential revenue leakage. This

capability will become even more essential as carriers interconnect

with multiple carriers and other solution providers, each one

providing a unique product or service which must be tracked and billed.

By leveraging a highly flexible interconnect billing system, a carrier

can eliminate revenue leakage by ensuring that every call is captured,

rated and invoiced correctly, regardless of which type of network the

call originated and terminated on. Combined with a end-to-end audit

and dispute management system, carriers will also be able to

effectively manage the countless interconnect invoices received as

well as streamline the validation process, reconcile charges and

manage settlements between multiple partners.

Succeeding in Today’s Telecom Environment

Over the next few years,

more and more carriers will be migrating away from traditional PSTN to

an IP centric network. The lower costs, increased network

efficiencies and the ability to develop and deploy new revenue

generating services on an IP centric network has made relying on

traditional TDM technologies a losing proposition for most carriers.

Yet, the promise of reduced costs and greater operational efficiencies

associated with these new networks will not be realized unless

carriers also optimize their entire interconnect business. Only by

deploying interconnect business optimization solutions that can manage

complex business agreements, optimize the routing of traffic, reduce

dial code risk and eliminate revenue leakage will carriers be able to

enjoy the benefits that IP centric networks provide.

Telarix, Inc.

8065

Leesburg Pike

Suite 600

Vienna, VA 22182

www.telarix.com

Lisa Perez

Regional Sales Manager (Americas)

[email protected]

+ 1 (703) 564 9626

Thomas D. Do

Solutions Consultant

[email protected]

+ 1 (312) 265 8330

Steve Chase

VP of Marketing

[email protected]

+ 1 (703) 564 9747

|